Your parents are so proud: you’ve finally hit that six-figure income sum after so much hard work, something they may only ever dreamed about. Small businesses struggle to regain footing as recession looms.Rage applying is the new quiet quitting for employees who feel unvalued.‘We can catch up’: At PDAC, new optimism critical minerals gap with China can be closed.David Rosenberg: What comes after a peak yield curve inversion? Nothing good.Banks beat the street, but can they outrun the downturn?.

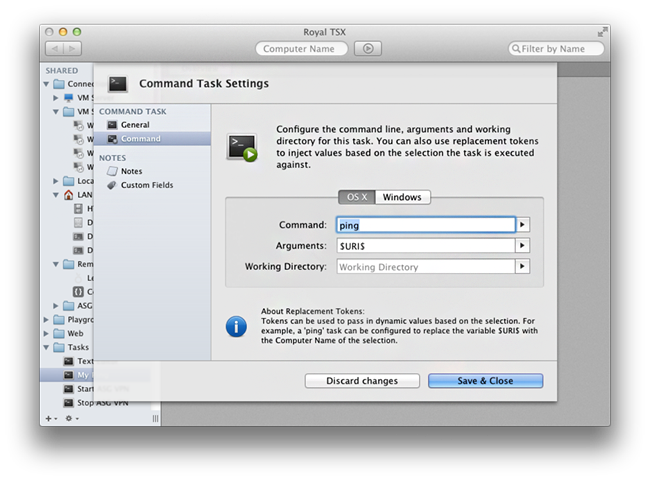

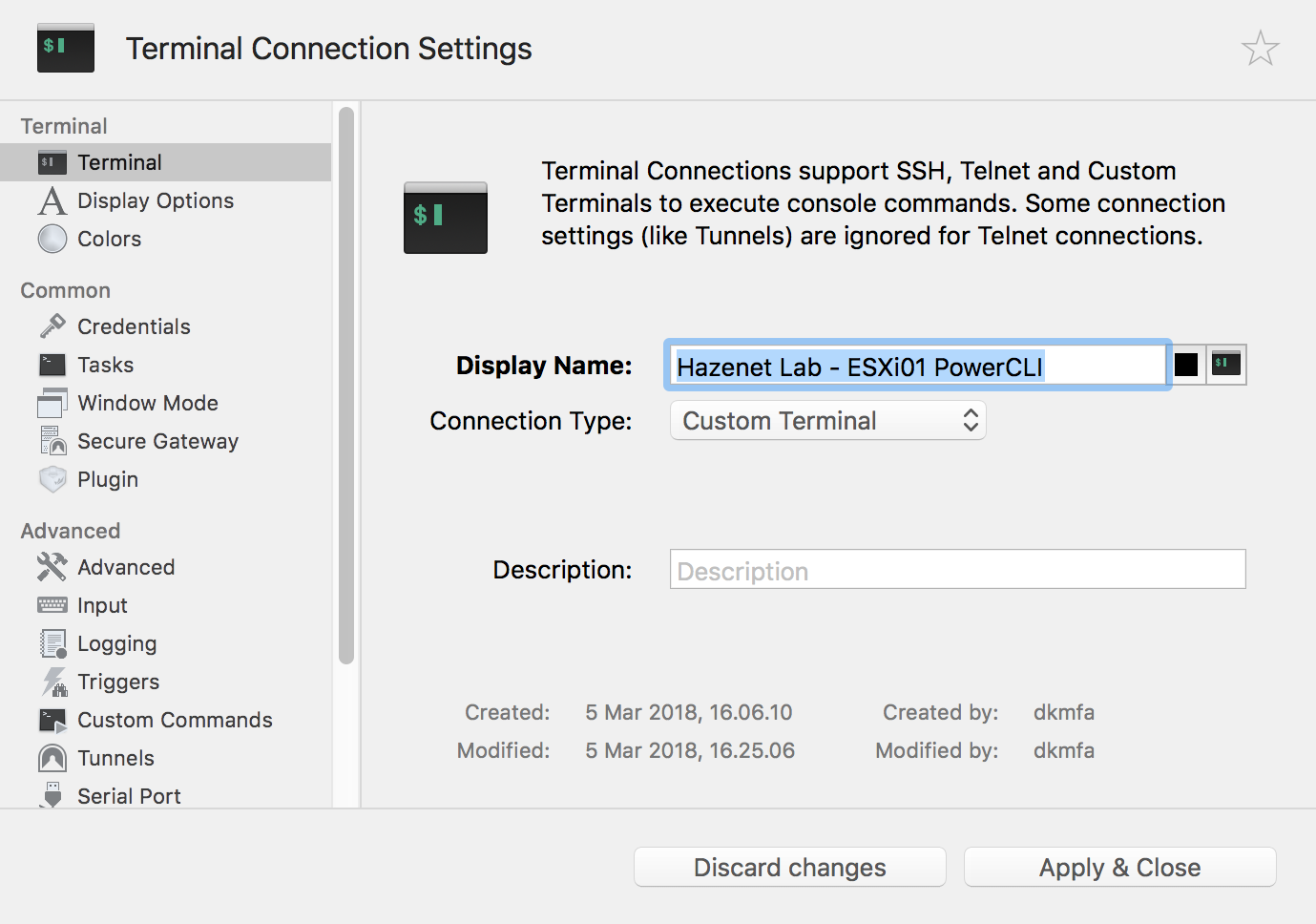

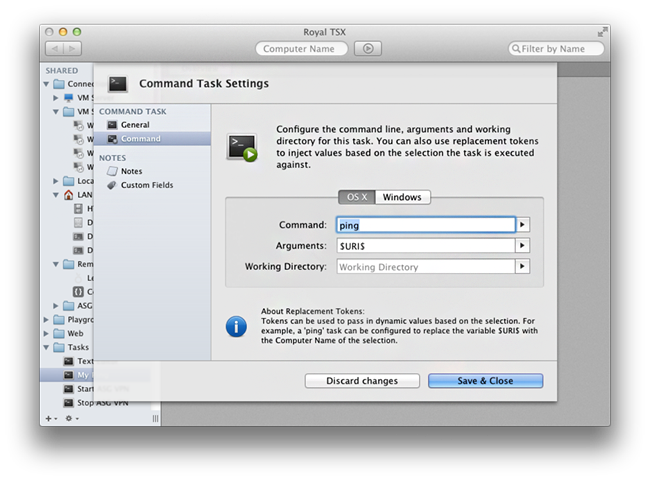

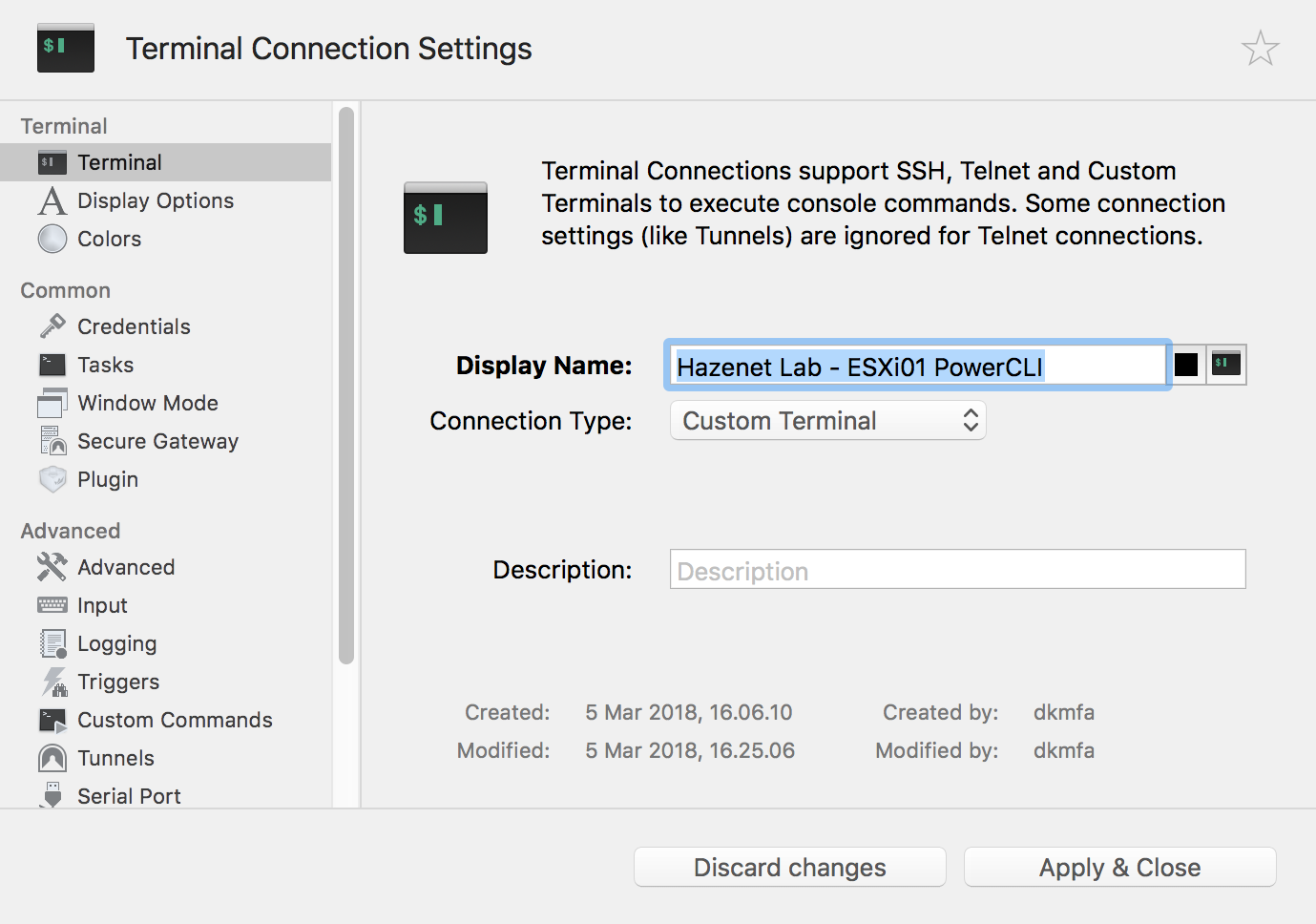

#Royal tsx. code

Maple Leaf’s Michael McCain says grocery code of conduct will have ‘absolutely no impact’ on food prices.Earnings: Linamar Corp., Spin Master Corp., Vermillion Energy Inc., Peyto Exploration & Development Corp., Trulieve Cannabis Corp., Transcontinental Inc., Adidas, Campbell Soup Co.ADP national employment report, goods and services trade balance, job openings and labour turnover survey Today’s data: Canadian merchandise trade balance U.S.and Jeff Hoffmeister, chief financial officer of Shopify, will participate in a fireside chat at the 2023 Morgan Stanley Technology, Media and Telecom Conference Harley Finkelstein, president of Shopify Inc.Dale Nally, minister of service Alberta and red tape reduction, will introduce legislation that cuts red tape.The Toronto Regional Real Estate Board hosts their 2023 market outlook and 2022 year-in-review event in York Region.The Broadbent Institute holds its 2023 progress summit.and Eric La Fleche, president and CEO of Metro Inc., appear as witnesses Galen Weston, chairman and president of Loblaw Co.

Michael Medline, president and CEO of Empire Co.

The standing committee on agriculture and agri-food meet on food price inflation. Mona Fortier, president of the Treasury Board and Liberal MP for Ottawa-Vanier, will also be present Filomena Tassi, minister responsible for FedDev Ontario, will make an announcement in support of women entrepreneurs in Ontario. Mary Ng, minister of international trade, export promotion, small business and economic development, will announce recipients of funding through the Women Entrepreneurship Strategy. United States Federal Reserve chair Jerome Powell testifies to the House Financial Services Committee on the Monetary Policy Report. Bank of Canada overnight rate policy announcement. Pre-pandemic, women made up roughly 55 per cent of workers in high contact-industries, but made up 80 per cent of those who fled those jobs during the crisis, according to a Royal Bank of Canada report released on March 7. They’ve exited high-contact industries, namely restaurants and hospitality, in droves, as they sought more stable employment in low-contact sectors such as professional, scientific and technical services and finance, insurance and real estate. Working-aged women have made significant career changes since the pandemic stated, which has led to the highest level of workforce participation on record. Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox. Last year, the Fraser Institute pegged June 15 as Tax Freedom Day, or the day that Canadians stop working to pay governments, and begin working for themselves. This advertisement has not loaded yet, but your article continues below. A mere six per cent said the average bill should be 40 per cent or more of a family’s income. More than half think the toll should be even less than that, and are willing to pay only 25 per cent or less of their total income to all three levels of government. That number is a big jump from the study’s start in 1981, when Canadians paid 40.8 per cent of income on taxes, the think-tank said.Ī family’s average tax bill goes beyond a yearly income tax payment to the Canada Revenue Agency, and is made up of fees such as sales taxes, property taxes, fuel taxes, payroll taxes and more.Ĭurious to see how Canadians feel about this growing burden, the Fraser Institute conducted a poll in partnership with Leger, and discovered that people aren’t exactly happy with how much they’re shelling out.Īlmost three-quarters of the 1,554 people polled said the average family’s tax bill is too high, and 80 per cent said it should amount to 40 per cent or less of income. The average family paid 45.2 per cent of their income in taxes to federal, provincial and local governments in 2022, estimates the Fraser Institute in its latest Tax Freedom Day report. The next issue of Financial Post Top Stories will soon be in your inbox. If you don't see it, please check your junk folder.

0 kommentar(er)

0 kommentar(er)